Testimonials

Stories of success from our clients

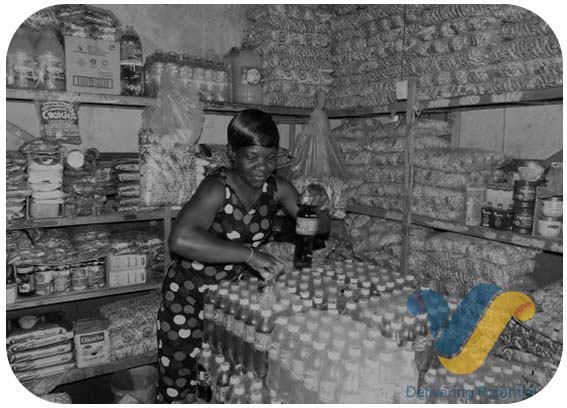

The story of Thandiwe Bafana

Who is Thandiwe? She is a mother, wife and businesswoman. For seven years this mother of two was into retail, but has now expanded to wholesaling. The retail shop was doing well but could not meet the rising demand, restocking was proving to be a challenge. Thanks to Wisrod Investments, she is now a proud businesswoman with a fully stocked shop.

In her own words: “As the business grew, we started facing financial constraints as we could not restock to full capacity. My husband was working for a national company and his salary was not enough to pay the children’s fees or meet our household expenses. We heard that Wisrod Investments was financing vendors and SMEs. I decided to visit their offices out of curiosity and realized that their loans were affordable and suited me. I took a loan and restocked my shop. Over time, the number of customers increased and so did my profits. My husband quit his job to assist me at the shop because I could not cope on my own. We have managed to send our children to school without any problems through the Wisrod school fees loans. Also, our house now feels like home through Wisrod’s hire purchase facility. I am thankful to Wisrod Investments who are doing great work to empower women in outlying areas where access to financial resources is not easy.”

The story of Abigal Gwasunda

BUSINESS: INDIGENOUS GRAINS VENDOR

The cheerful Abigail Gwasunda (60) is a widow and granny who describes herself as “the happiest woman on earth.”

In her own words: “My association with Wisrod Investments is now 5 years old. When I look back, I realize I have come a long way. My husband passed on in 1998 and I was unemployed. It was not going to be easy to take care of my two children on my own. In 2010 I decided to join Wisrod Investments together with other women in the market. During that time, I was selling kids snacks, but it was not profitable enough to meet my family needs. I used the loan from Wisrod to finance my snacks business. I maintained my repayment schedule and kept getting loans from Wisrod which further helped me scale up the business. It took some time, but gradually our income and quality of life improved, then I started selling grains and dried vegetables. I managed to send my children to school, as well as buy building material to build my house through the Wisrod micro-housing loan. I am thrilled at the notion that soon I will no longer have to stress myself with rentals because I will be a landlady.”

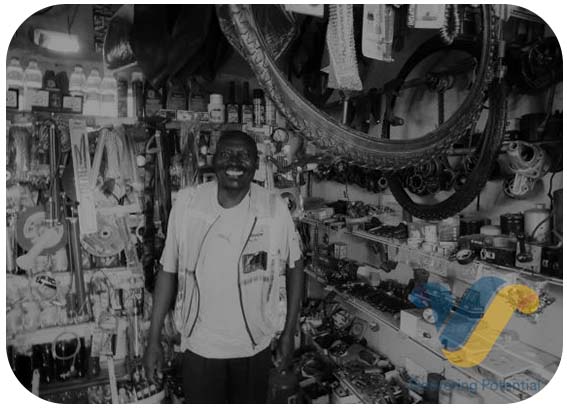

The story of Felix Sayi

BUSINESS: HARDWARE SHOP

Operating from Lower Gweru, Mr Sayi (64), is a family man with six children. He has run his hardware shop for 9 years.

In his own words: “The hardware business requires enough capital to be well-stocked as well as keep up with market demands as I am the sole provider of hardware services in Lower Gweru. I decided to take a loan in 2018 due to financial instability. The working capital was not sufficient to generate income considering the expenses I had both at home and at work. Wisrod staff visited my shop when I was really in need of money and contemplating where I could get a financial assistance. They explained all the terms and conditions and to my surprise there was nothing difficult to understand and I signed up for the idea. The process was very easy and fast. The following day I got my loan. It has been two years now, and business has never been this easy. I can now generate income to take care of my family and plan for the future. I am grateful to Wisrod Investments for taking me this far. I could not have made it without them.”

The story of Marshal Zvida

Mobile phones and accessories

Marshal Zvidza is a proud father of two. He has been selling mobile phones for six years now. Unfortunately, his story is not all rosy because he suffered a setback when he lost all his stock to theft.

In his own words: “After the loss due to the theft, I did not lose hope, but started to restock again with the little savings I had. The money was not enough to finance the business as well as fend for my family. I decided to engage Wisrod Investments as my financial partner, they gracefully accepted me. I took my first loan and the business grew over time, gradually increasing our household income. I cannot even imagine what our lives would have been without the financial support from Wisrod Investments. I am grateful that I got an opportunity to change my life. I feel so blessed this opportunity came my way when I needed it.”